Seasons – March 2022

From the Plateau Land & Wildlife Management Team

Though it may not feel like it just yet, spring is right around the corner. And with the changing of the seasons, we see a resurgence of wildlife including our celebrated wildflowers, pollinators, and songbirds. Spring is an opportune time for landowners that are managing for birds, or have an interest in birding, to do activities that benefit the different bird species on their properties.

In this issue of Seasons, you’ll find guides by Plateau’s team of biologists and Wildlife Management staff covering how to begin bird watching on your property this spring, census bird counts that can count as a Wildlife Management activity, educational webinars, news for Texas Landowners and more. We hope you enjoy all that this Seasons and season have to offer and, as always, we are here to help when you need it!

Until next Seasons,

The Plateau Team

Table of Contents

Wildlife Management Tax Valuation: A Tool for Conservation

Wildlife Management Activity Reminder: Spring Wildlife Surveys

Service Spotlight: Winter Webinar Series

Birding Basics for Landowners

An Office With A View

Common Property Tax Pitfalls

Field Notes: Pictures and Highlights of Properties in Wildlife Management

News for Texas Landowners

Wildlife Management Tax Valuation: A Tool For Conservation

By Shane Kiefer, Director Of Ecological Services, Certified Wildlife Biologist, Senior Property Tax Consultant

Texas has more privately owned, working land than any state – 142 million acres, according to Texas A&M Natural Resources Institute (NRI). That’s about 82% of the state dedicated to farms, ranches, and forests. These lands provide essential services for all Texans, from food and fiber, to clean water and air, and even outdoor recreation and a sense of pride.

The growing Texas population leads to increased demand and rising land prices, which creates an incentive for landowners to sell part or all of their property. Land fragmentation is a principal concern in conservation because it typically causes habitat fragmentation. But ownership lines on a map don’t have to mean hard lines on the land.

Since all that land is privately owned, incentives are essential to encourage conservation. There are cost-share programs at the state and federal level for implementing conservation practices, but the most important incentive program in Texas is the open-space tax valuation (commonly called ag exemption or wildlife exemption). Ag, timber, and wildlife exemptions are essential for many landowners, particularly traditional rural landowners and producers, to retain ownership of their land by making it possible to simply afford the tax burden. Rising prices are great when you are selling, but when you are paying the taxes, we’d all like our property to be worth a little less.

The tax incentive is so great that special valuations like wildlife management actively encourage conservation practices like rotational grazing, brush management, deer population control, wildlife-friendly hay production, and prescribed burning. Even better is that these special tax valuations still generate more tax revenue than they cost in government services (see an explanation of that here).

Now imagine you own 1,000 acres that your family has held onto for the last 40 years because you had favorable taxes under your agricultural appraisal. Perhaps the cattle market is in the tank, or we’ve entered another decade-long drought like in the 1950s. Maybe you just don’t want to mess with livestock anymore. You do want to keep the land together for your family and your heritage. Wildlife management valuation is a tool that lets you accomplish these goals by keeping your taxes low while you practice conservation and active management to protect your piece of Texas.

What if that same property is just too valuable for you to resist selling, but you still care about the legacy of your land and how it is treated by future owners? Instead of selling off 50 to 20-acre estates to different folks that all treat their ranchette like a big yard, these new rural landowners can be incentivized to practice active wildlife management for the tax savings. This helps keep much of the habitat intact so even though the land is highly fragmented, the wildlife habitat and the essential services the land provides are still largely whole.

These are just a couple of ways that wildlife management works as an active tool for conservation. If you spend time on the NRI Texas Land Trends site, you’ll see how important it can be. While Texas has lost 2.2 million acres of working lands since 1997 (about ¼ acre for every new Texan in that time), over 5 million acres have been put under wildlife management in that same time. There’s no data to say how much of that would have been lost without the wildlife valuation law, but that’s 5 million acres of private land that is required to be actively managed for wildlife. That’s a lot of habitat protected with a pretty powerful tool.

This article was originally published in an April 2020 edition of Seasons.

If you have questions or would like more information about appropriate Wildlife Management activities for your property, please contact us at (512) 894-3479 or plateau@plateauwil1dev.wpenginepowered.com.

Wildlife Management Activity Reminder: Spring Wildlife Surveys

By Kameron Bain, Landowner Account Manager

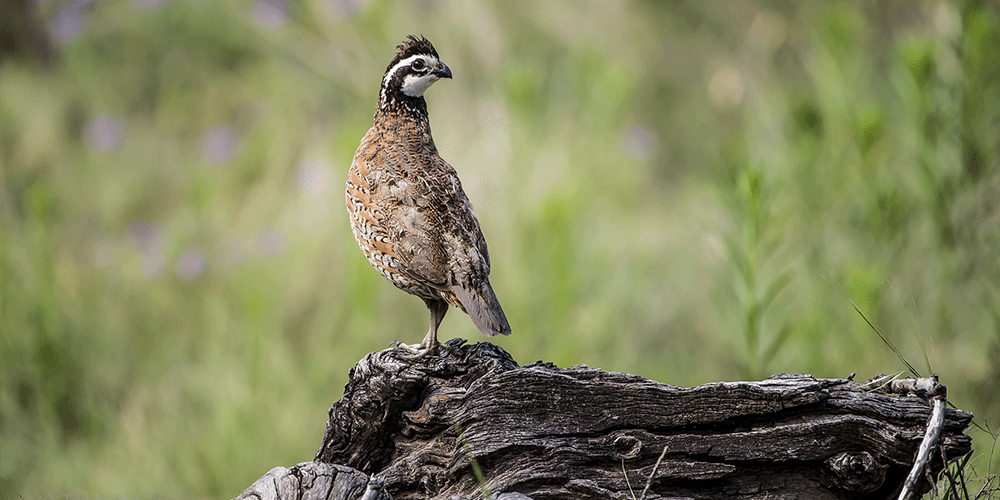

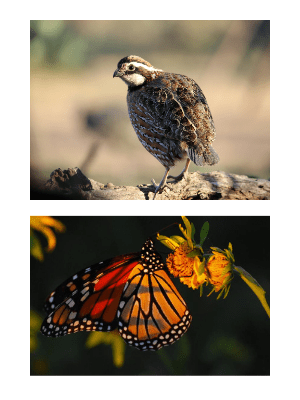

Spring is migration season for birds and monarch butterflies and breeding season for many species of wildlife, so it is a great time to get out and count.

Spring is migration season for birds and monarch butterflies and breeding season for many species of wildlife, so it is a great time to get out and count.

For informal surveys, simply watch your feeders and water sources and record who is visiting. You can do this by watching in the morning or evening and keeping a log of what you see. You should do this regularly (weekly or monthly) throughout the breeding season or all year long. You can also use remote game cameras that can watch 24/7.

Download the iNaturalist app to help you identify and catalog wildlife and plants seen on your property. See Plateau’s tutorial on iNaturalist.

- Time-Area counts are structured surveys that involve sitting at representative points throughout your property for a set period of time (typically 10 minutes) and recording all wildlife seen or heard within a set area. These are typically done seasonally, but spring is a great time to start.

- Spring call counts for quail are structured surveys where independent listening stations are set up throughout your property to count individual quail calling in the early morning.

- Spring Breeding Bird Surveys are point-count surveys focused on birds that are seen and/or heard at representative stations throughout your property.

All of these surveys are most informative when conducted annually or more often to establish trends in wildlife use of your property. It’s easy to get behind on activities – we’re here to help answer questions or do the work for you! Contact us at (512) 894-3479 or plateau@plateauwil1dev.wpenginepowered.com to discuss appropriate wildlife surveys for your property, or get help conducting them.

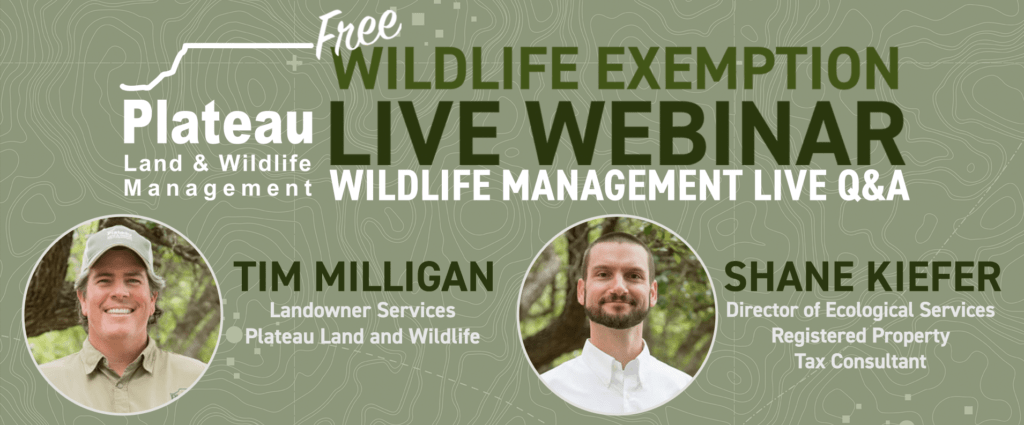

Service Spotlight: 2022 Winter Webinar Series

Plateau’s 2022 Winter Webinar Series

Whether you made it to our wildlife webinar series, or maybe you missed it, join our free LIVE Q&A to receive answers to any remaining questions about Converting to Wildlife Management before the April 30th deadline.

Join our panel of experts Tuesday, March 8, or Thursday, March 10, from 6:00-7:00pm.

They’ll be available discuss the differences between traditional Ag Valuation and Wildlife Management property tax valuation, more commonly referred to as a “Wildlife Exemption,” and how to make the switch. Get all of your Wildlife Management questions answered with this FREE webinar and live Q&A.

Submit your questions during the webinar and receive live answers from Plateau Land & Wildlife Exemption Specialist and Property Tax Consultants, who hold over 20 years of experience working with landowners making the transition from traditional Ag or Timber to Wildlife.

The deadline to transition to Wildlife Exemption is April 30th,

so don’t wait to learn more.

View topics and featured speakers and register for upcoming events by visiting Plateau’s Event Directory. For questions or more information, contact plateau@plateauwil1dev.wpenginepowered.com or (512) 894-3479.

Back to TopBack to Top

Spring Birding Basics For Landowners

Whether you are in Wildlife Management or not, an exciting activity for many landowners is watching and identifying the various birds that frequent your property.With spring just around the corner and migration beginning, now is the time to get outside on your property and see which species of birds are prevalent.

In this one-hour webinar, Plateau Wildlife Biologist Danielle Belleny provides some basic insights and tools to help you get started birding! Danielle covers some behaviors, sounds, and appearances of birds in Texas. She also provides suggestions of native plants that will help attract and benefit birds on your property.

Back to TopBack to Top

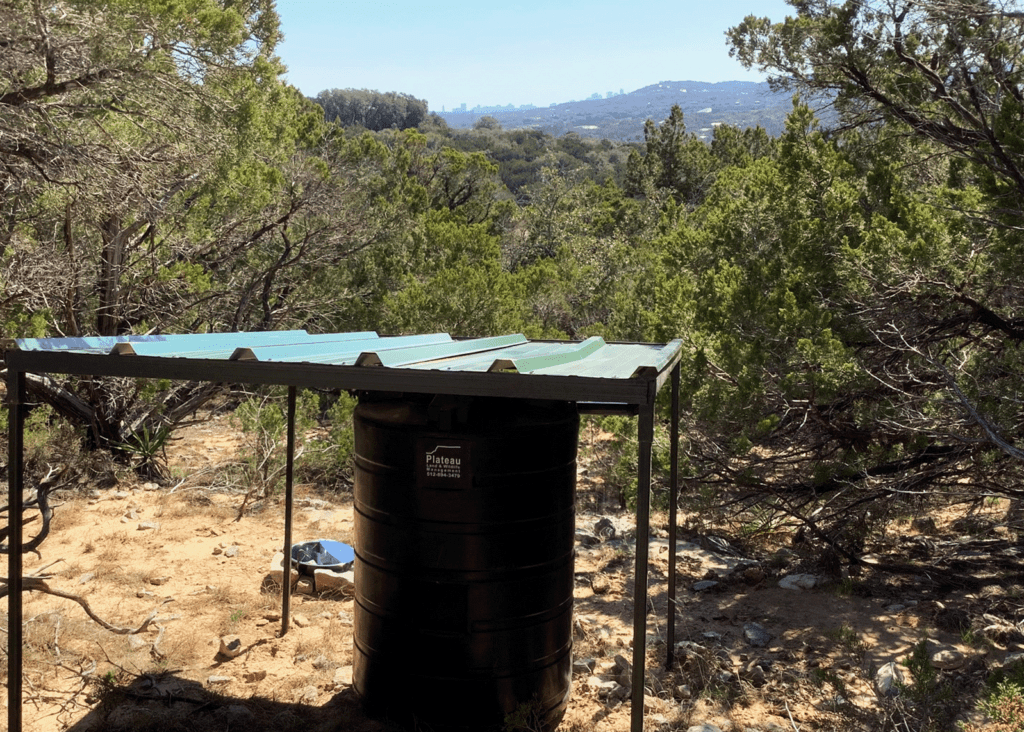

An Office With A View

Check out this awesome view of the Austin skyline! This image was captured by Products & Services Technician II and Associate Wildlife Biologist, Cody Keene, while working on a job site in Travis County. Not a bad office view!

Ready to join? Learn more at https://plateauwildlife.com/careers/

Back to TopBack to Top

Avoiding Common Property Tax Pitfalls

By Cassie Gresham, Braun & Gresham Attorney and Counselor

My work on behalf of landowners often involves helping them fix a problem or get out of a bind with their local appraisal district. Through the years, I have seen some common mistakes that can lead to big problems:

My work on behalf of landowners often involves helping them fix a problem or get out of a bind with their local appraisal district. Through the years, I have seen some common mistakes that can lead to big problems:

- Be aware of the deadline to file your annual report

Did you know that there is no state statute setting a deadline for annual reports? Therefore, many appraisal districts set their own deadlines for filing annual reports. You should know exactly what the deadline is each year in your particular county.

- Be able to document your use of your property for open space

Landowners should have a written lease for their property to document who is using their property and how their property is being used for agricultural use. If you are using your property for wildlife management, then you should have an up to date wildlife management plan that you are following. When you implement the wildlife management activities on your property, you should document (take pictures, keep a journal, etc.) your work.

- Was there an ownership change? You must re-file your application

You need to re-file an application in your own name if you have recently purchased a property. But, you also need to re-file an application even if you are just transferring the property into a new entity that you still own (i.e. LLC, LLP, Trust). Failure to file a new application will result in the loss in your open space valuation.

- Always review your Notice of Appraised Value

The Notice of Appraised Value usually arrives in April/May each year. It shows you not only what the market value of your property will be for that year, but it also indicates whether or not your property will qualify for an open space valuation. Many appraisal districts consider the Notice of Appraised Value as the notice they provide if there is a problem.

- Make sure to protest

You should protest each year if your property value has increased above the market value or is not being taxed in a similar manner to your neighbors. You should also protest if your ag or wildlife management valuation has been removed. You typically have 30 days to protest from the date that you receive notice that your ag or wildlife management has been removed. Or you should file a protest no later than May 15th, whichever is later. You can file a late protest, but you should file it before the appraisal district certifies their tax rolls. The certification usually occurs in late July.

- Make sure to pay your taxes by January 31st

You should pay your taxes by January 31st of each year, even if you have filed a protest and are waiting on a hearing or waiting on a lawsuit to be resolved. If you have lost your ag or wildlife management valuation and have filed a timely protest, then you at least need to pay the amount not in dispute or the amount of taxes you paid last year when you had an ag valuation. Failure to pay the taxes (even the undisputed amount) will result in a forfeiture of your protest or lawsuit.

- Know the agricultural history of a property you are purchasing

Ask the seller to provide documentation of approval of the ag or wildlife management use before you purchase the property. You want to obtain any written leases or evidence of practices that have been implemented on the property prior to closing. When you make an application in your own name, you might be asked by the local appraisal district to demonstrate the history of use of the property. You will only have this information if you have previously requested it from the seller as part of your due diligence in purchasing the property.

- Continue your use of the property for ag or wildlife management, even if you don’t qualify

Even if your property didn’t qualify for ag or wildlife management in a particular, you should continue the use of the property for ag or wildlife management use. This will allow you to avoid rollback taxes by demonstrating that there is no change in use in the property.

- Additional Notice is required to landowners who are over 65

In 2015, the Texas Legislature passed a law that requires additional notice to landowners who are over 65. If a chief appraiser believes there is a change in use of the property, then they are required to provide notice to the over 65 landowner. If the chief appraiser doesn’t receive a response within 60 days, then they are required to follow up with the landowner. This new law provided additional protection for landowners and a higher standard for appraisal districts. Most appraisal districts are not aware of this additional notice and fail to provide it. - Communicate your local appraisal district

Haven’t heard from your local appraisal district by April 1st? Call them. Many of the problems that we have to solve are due to lack of notice. If you are talking to your local ag appraiser, you are more likely to know if there is a problem. Why do I suggest the date of April 1st? Because it still gives you time to solve any problems that need to be addressed (i.e. file a new application, annual report or a protest).

If you have questions or concerns about your property tax status, bill, or filing a protest, Braun & Gresham can help. The attorneys at Braun & Gresham are not only experts and innovators in ways to utilize property tax incentives and how to reduce your property taxes, but we also serve as your advocates when you are unfairly taxed.

We know the rules and how to use them. We also make sure the taxing authorities follow those rules. Please contact Braun & Gresham at (512) 894-5426 or email info@braungresham.com.

Field Notes: Pictures & Highlights of Properties in Wildlife Management

Ever wonder how Wildlife Management is benefiting landowners’ property and the wildlife that lives on it? Here are some photos and highlights, from Plateau’s field staff and game cameras, of successes and small victories our landowner customers are seeing on their property.

Plateau Land and Wildlife’s Platform Feeder: Turkey Tested, Turkey Approved!

Check out this video of wild turkeys enjoying a Plateau Land and Wildlife’s Platform Feeder.

Products & Services Division Assistant Manager Quincy Kennedy said the wild turkey on this Gillespie County property did not originally use the platform feature of the feeder, and only ate what fell to the ground. When the property owner asked what he could do to encourage the turkey to climb on top of the platform, “We recommended leaning a ladder against the side of the feeder,” Kennedy said, “and told him the turkeys would catch on eventually. They finally figured it out after 3 months!”

Some turkeys need a little extra help! Interested in testing this method out with your PLW Platform Feeder? To prevent non-target species from accessing the feed, remember to remove the ladder once the turkeys begin feeding from the platform.

So many of you are out there doing great work. We appreciate you, and so do the native wildlife on your property and across Texas. Large or small, you are making a difference. Look for more great examples of wildlife and landowner successes and victories in upcoming Seasons Newsletters!

News for Texas Landowners

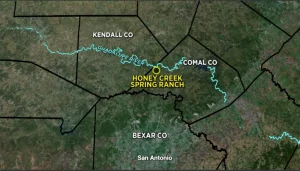

More than 600 acres in Comal County become protected land

Article by Justin Horne, KSAT 12 San Antonio

Texas Parks and Wildlife Department combined forces with the Natural Resources Conservation Service and the Nature Conservancy to safeguard Honey Creek Spring Ranch in Comal County from future development. Honey Creek Spring Ranch, which has been owned and operated the Moore family for more than 150 years, has been regarded as an area of ecological importance. This is not the first time land in this area has received a conservation easement. In 1981, the Nature Conservancy acquired 1,825 acres in Comal Country. That acreage was transferred to Texas Parks and Wildlife to create a 2,294-acre Honey Creek State Natural Area.

Powderhorn Ranch will soon be home to a massive $50M Texas state park, 2 hours from Houston

Article by Chris Shelton, Houston Chronicle

The $50 million Powderhorn Ranch is closer to becoming a state park. However, there is still a lot of work to be done before Houstonians can make the 2.5 hour trek to the 17,000-acre property near Matagorda Bay.

The Texas Parks and Wildlife Department closed on the final portion of the property in October in a private-public partnership with the Nature Conservancy, the Texas Parks and Wildlife Foundation and The Conservation Fund. The state park at Powderhorn could open about a decade from now, Texas Monthly reports. The department still needs to complete surveys, host public meetings, outline a master plan and raise more money before construction can kick off.

Report: Texas Parks and Wildlife to adopt more prescribed burn protocols after Rolling Pines fire in Bastrop County

Article by KVUE Staff

BASTROP COUNTY, Texas — The Texas Parks and Wildlife Department will now implement new procedures for future prescribed burns after an independent review of the Rolling Pines fire in Bastrop County, according to a report by KVUE’s news partners at the Austin American-Statesman. The review by a panel of independent experts looked at the preparation, planning and execution of the prescribed burn in addition to weather and windspeeds. It also looked a staff, equipment and safety resources.

According to the report, a prescribed burn requires low humidity for the fire to burn at a steady pace and winds of no less than 6 mph. The National Weather Service reported winds in the Austin area between 15 to 25 mph with gusts between 30 and 40 mph and a burn ban was not in effect for Bastrop County on Jan. 18, the day the fire started.

Millions of fish, bats, deer and other Texas wildlife died in February 2021 storm, officials say

Article by Texas Parks and Wildlife Department

Winter Storm Uri was the event’s official name, though it was nicknamed Snowmaggedon. Uri dragged an arctic wrecking ball southward through the nation in mid-February, leaving at least 223 people dead, 210 of them perishing in Texas.

The storm also had significant impacts on wildlife, plants and the state’s natural ecosystems. In addition to the unfolding human tragedy, Texas wildlife — from cold-stunned turtles to saltwater fish kills to bat die-offs — was struggling to survive the unusually long and brutal storm. One year later, we look back at the storm’s impact on our wildlife and the response from the Texas Parks and Wildlife Department and partners.

First bat falcon spotted in US at Texas wildlife refuge

Article by FOX4KDFW

ALAMO, Texas – The U.S. Fish and Wildlife Service said the country’s first recorded bat falcon sighting happened at Santa Ana National Wildlife Refuge in Alamo, Texas last December.

“Everyone that can catch a glimpse is looking at this bat falcon right now,” officials recently posted on its Facebook page. “This is the first recorded time that a bat falcon has ever been seen in the U.S.!”

Seventy-eight-year-old Peter Witt of College Station took a trip earlier this month just to spot the rarity and snap a photo. The couple recently picked up an interest in spotting birds, with enthusiasts known as “birders.”

Sorry, the comment form is closed at this time.