Seasons – December 2020

From the Plateau Land & Wildlife Management Team

We’ve seen a few cold snaps here in Central Texas and we are all getting in the holiday spirit. This time of year is full of joy, relaxation*, and celebrations.

The holiday season is also a time for evaluation of our successes and challenges – a time of reflecting and looking forward. We encourage you to think about your land and wildlife management journey as we come to the end of the year. This Seasons is full of year-end considerations for landowners including annual report requests, activity suggestions for wildlife management properties, estate planning and more.

As you tie your final ribbons on gifts and reflect on the closing of another year, be sure to add wildlife management valuation to your list of those things you did right this year – because an investment in the enjoyment of your land, the heritage of land ownership, and protecting our natural resources is something that will pay dividends for many more years to come.

Happy holidays to you and yours.

Until next Seasons,

The Plateau Team

*Editor’s Note: Our busy field technicians may disagree with the relaxation part as they brave the elements to dutifully complete end-of-year activities for our landowners.

Table of Contents

Annual Report Requests & Record Keeping

Texas Ag/Timber Tax Exemption Numbers (Ag Cards)

End of the Year Wildlife Management Activities

‘Tis the Season to Start Talking

Plateau Land Group Featured Listing

News for Texas Landowners

Annual Report Requests & Record Keeping

By David Riley, Staff Biologist II – Annual Report Administrator, Associate Wildlife Biologist, and Registered Property Tax Consultant

Each year, many County Appraisal Districts (CADs) request annual reports from Texas landowners in Wildlife Management as a way to ensure that landowners are in compliance with their wildlife management activities without having to visit their property. With the end of the year nearly here, we want to remind wildlife management landowners to be aware of this and the importance of good record keeping.

Most counties require your annual report to be submitted prior to April 30 of the following year, which documents activities conducted during the prior calendar year. Plateau offers a service to take this weight off your shoulders. A Plateau Annual Report is thoroughly prepared by a Plateau biologist and includes a Texas Parks & Wildlife annual report form, organization of all activity documentation, and the peace of mind that your Wildlife Management Valuation stays in place for only $495.

A well-composed annual report can prevent unnecessary attention from the CAD and is the best way to protect your valuation. Plateau does more than 800 of these each year. We maintain great relationships with all the CADs and know precisely what information they will want to see.

With more and more CADs requesting this report every year, it is essential that qualifications are met and well documented for each year, and on all wildlife management properties. A well-done and complete annual report can make all the difference. Your annual report is your best opportunity to show the appraisal district what you’re doing and is the only thing they may ever see that shows them your commitment to Wildlife Management.

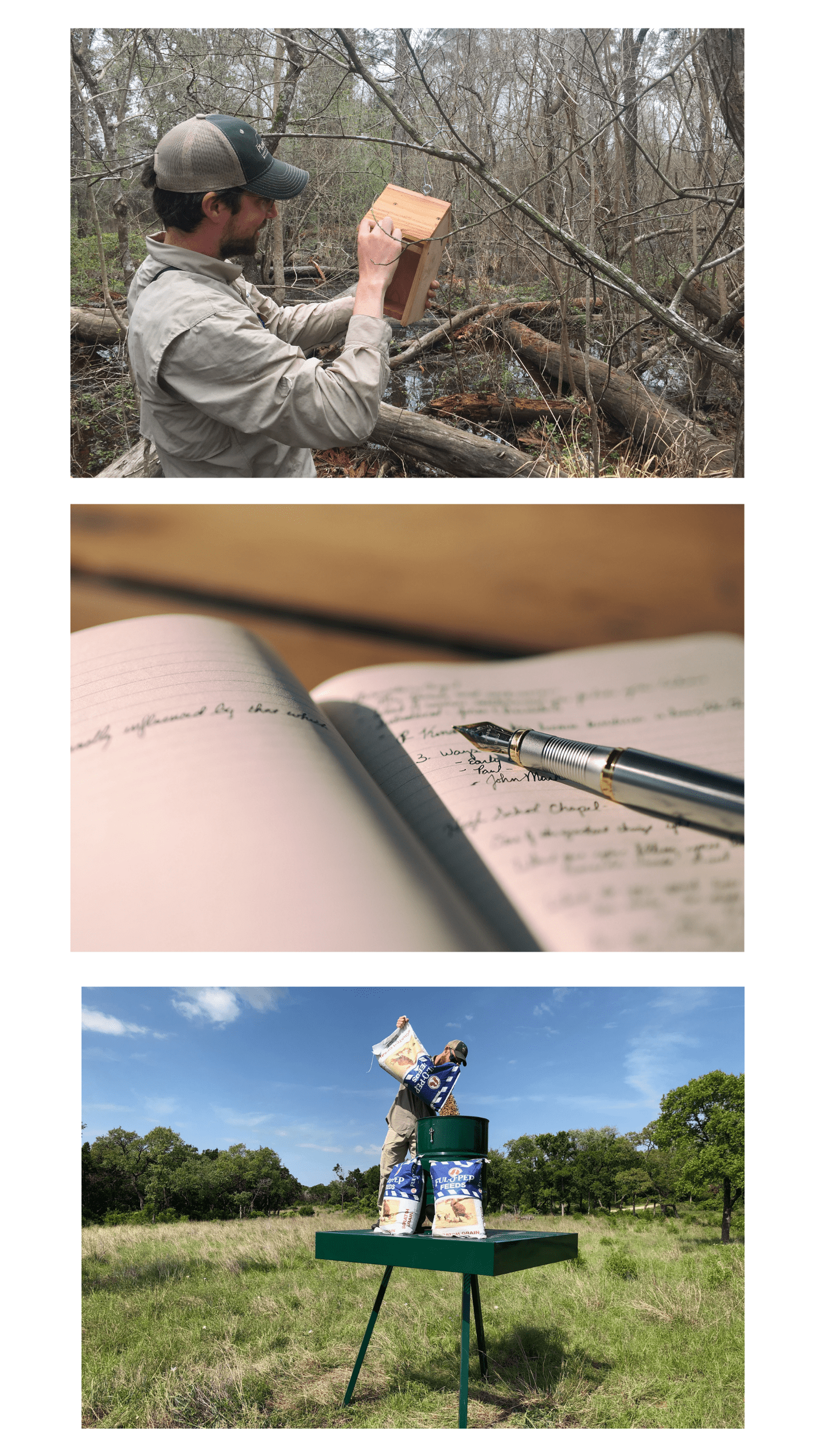

Record Keeping Tips:

- Always take photos of your activities

-

- Take new photos every year of each activity even if nothing has changed. e.g. feeders, nest boxes, water sources, etc…

- Be sure to take before and after photos of activities like brush management, pond construction, etc…

- If you think that it is a wildlife management activity then you should take a photo of it

-

- Keep accurate logs of the activities conducted

-

- Either keep a logbook at the property or in the vehicle/UTV you use around the property

- Keeping accurate logs with the date(s) and status of the activity conducted

- It’s best to keep a log at the time you do the activity so you don’t have to remember it later

- Follow this link to downloadable activity logs

-

- Refer to your wildlife management plan

-

- Your wildlife management plan is your guide to what activities might be best for your targeted species

- This can help ensure that you are meeting minimum intensity requirements with your activities

-

- Keep receipts for all wildlife management activities

-

- This can be for feed, nest box parts, brush management equipment, etc…

-

- Organize all documentation by activity

-

- This makes it easier for you to see exactly what you have done throughout the year and becomes a checklist to ensure that you meet minimum requirements (Minimum requirement is 3 of the 7 activity categories)

-

- Utilize maps when possible

-

- Mark areas where feeders, water sources, nest boxes, etc. are located

- Draw areas where brush management, erosion control, fire ant treatment, etc. occur

-

If you have received an Annual Report request from your CAD, it is very important that you complete the required forms and provide adequate documentation of your activities. Plateau can help. Contact us at (512) 894-3479 or [email protected] if you have questions, or would like to purchase a Plateau Annual Report.

Texas Ag/Timber Tax Exemption Numbers (Ag Cards)

By Sarah Kahlich, Senior Wildlife Biologist and Associate Wildlife Biologist

If your property qualified for an Ag valuation, you probably applied and were granted an Ag tax exemption number from the State of Texas (also referred to as an Ag card). This tax exemption number allows farmers, ranchers, and timber producers an exemption from sales tax on qualified items. For a rancher, that might be buying a new tractor and shredder tax-free.

If your property qualified for an Ag valuation, you probably applied and were granted an Ag tax exemption number from the State of Texas (also referred to as an Ag card). This tax exemption number allows farmers, ranchers, and timber producers an exemption from sales tax on qualified items. For a rancher, that might be buying a new tractor and shredder tax-free.

Unfortunately for landowners who convert their agricultural land into wildlife management valuation or lost their ag valuation these tax exemption numbers can no longer be used to purchase items tax-free (or at least legally should not be used to do so if you still retain the tax exemption number). Landowners who were in Ecological Laboratory and transitioned into wildlife management are not eligible for a tax exemption number. The comptroller’s website: https://comptroller.texas.gov/taxes/ag-timber/, has useful information on who and what qualifies for a tax exemption number. In the ‘Overview’ section at the top of the page, there is a link, ‘What Activities Do Not Qualify?’ There is a list of activities that cannot use the tax-exempt number, wildlife management and conservation is the fifth bulleted item.

Wonder why wildlife management does not qualify for sales tax exemption? Or still not sure if you qualify for the tax exemption number? Per the Comptroller’s website, “A person who does not produce agricultural or timber products for sale is not eligible for an ag/timber number.” Depending on the scenario, if your property is currently in Ag valuation, you may or may not qualify for an ag/timber number. If you lease your land and your lease agreement states you are to maintain fences, then you are not eligible for the ag/timber number. If you lease your land and the lease agreement says you are responsible for providing grass for the cattle, then you are eligible for a tax number. If a portion of your property is in Ag and the other portion in wildlife, you can still have an Ag number for the portion in Ag to produce hay, crops, or livestock. If you use a tax exemption number to buy a Mule to drive around your property, the new Mule you bought tax-free is supposed to be exclusively used for Ag production, not for your hunting lease or other recreational activities.

Wonder why wildlife management does not qualify for sales tax exemption? Or still not sure if you qualify for the tax exemption number? Per the Comptroller’s website, “A person who does not produce agricultural or timber products for sale is not eligible for an ag/timber number.” Depending on the scenario, if your property is currently in Ag valuation, you may or may not qualify for an ag/timber number. If you lease your land and your lease agreement states you are to maintain fences, then you are not eligible for the ag/timber number. If you lease your land and the lease agreement says you are responsible for providing grass for the cattle, then you are eligible for a tax number. If a portion of your property is in Ag and the other portion in wildlife, you can still have an Ag number for the portion in Ag to produce hay, crops, or livestock. If you use a tax exemption number to buy a Mule to drive around your property, the new Mule you bought tax-free is supposed to be exclusively used for Ag production, not for your hunting lease or other recreational activities.

All existing tax exemption numbers expired on December 31, 2019. To continue to claim sales tax exemption on your qualified Ag property, you needed to renew your number with the comptroller. Ag/timber numbers must be renewed every four years.

If you are just wanting to save money and not pay taxes on a new tractor or other equipment and have a tax exemption number, but not a valid Ag producer anymore, misuse of an ag/timber number may result in criminal and civil penalties for the number holder, as well as revocation of the number (per comptroller website). I highly recommend reviewing the above website, especially their FAQs section, there is a lot of information you need to know about having a tax exemption number.

Questions? Give us a call at (512) 894-3479 or email [email protected]

End of the Year Wildlife Management Activities

By Kameron Bain, Landowner Account Manager

Don’t let 2021 sneak up on you before you complete your 2020 wildlife management activities!

As the end of the year rapidly approaches, we want to make sure you are on track to finish your qualifying wildlife management activities and that they are well documented. The good news is, if you still need to meet any of your wildlife management requirements for 2020, it’s not too late. There are plenty of winter activities to choose from, and of course, Plateau is always here to help when you need us.

Year-End Wildlife Management Activities

- Brush management

- Wintering and resident bird survey

- Remote camera wildlife survey

- Imported red fire ant control

- Deer, wild pig and exotic harvest

- Re-seeding wildflowers and native grasses

- Strip mowing and discing

- Chemical control of prickly pear

- Cut-stump herbicide treatments

- Tree and shrub planting

- Brush pile construction

- Wildlife products and installation (food, water, shelter)

All of our Plateau products and services are designed to fulfill your wildlife management activity requirements.

Uncertain about whether or not you’re meeting wildlife management requirements? Plateau can help!

- Annual Report ($495): Let the experienced team at Plateau professionally prepare this important report and rest assured that it’s been done right.

- Wildlife Management Activities Check-Up ($595): Assess your property, documentation and current activities with a Plateau biologist to ensure compliance.

- Consulting Site Visit ($795): Spend a few hours with a Plateau biologist touring your property. This personal site visit is customized to the characteristics of your property, its wildlife and you.

If you have questions about any of your activities or are interested in purchasing a Plateau product or service, please contact us at (512) 894-3479 or email [email protected].

‘Tis the Season to Start Talking

By Margaret Menicucci, Braun & Gresham Attorney and Counselor

As seen in Margaret Menicucci’s 2017 blog for Braun & Gresham.

My father passed away in 2010, after a long and meaningful life. Visits to my parents’ home were periodic because I live in a different state. In the last few years of his life, each time I visited, he would make me sit in his study and review his assets, his filing system, his meticulous records, and his plan for supporting my mother so she could continue to live at home after he passed. When he died, he left plenty of resources to support my mother comfortably. He also left a clear and effective Will, beneficiary designations on his accounts, and guideposts in every file in his study that would help me help my mother manage those assets that are critical to her support and comfort. He taught me this powerful lesson about estate planning: an excellent estate plan requires good documents and records and meaningful communication of your goals and expectations with your loved ones.

In 2016, Fidelity Investments conducted a study focusing on the extent to which parents and their adult children communicate in-depth about a range of financial and retirement topics. In the study group, 69% of the surveyed parents of adult children said they have had detailed conversations about their estate plans, but 86% of the surveyed parents said they had not had in-depth (or sometimes any) conversation with their children about long-term care and eldercare. The issues around eldercare and long-term care are especially sensitive and, at times, complex.

‘Tis the season to start talking.

Family visits in the next few weeks are prime time for discussions about parents’ long-term care and their legacy – how they want to pass their assets to family and their community. Certainly, an estate plan provides the critical tools for directing the care of aging parents and for distributing wealth when they die. A strong estate plan will include a Will or revocable living trust along with disability planning documents such as financial and medical powers of attorney and a health care directive. Our role, as your attorneys and counselors, is to guide you and your family in creating a personalized estate plan that works well. Communication among family members, however, provides that extra level of certainty that the estate plan will be implemented correctly and with respect for personal goals.

It may be too awkward to transition a conversation from football stats to medical powers of attorney. You will have more success with intentionally and honestly asking to set aside time for a discussion (not unlike my father bringing me into the study to review records). A request for time signals the importance of these conversations – this communication is about working together as a family to care for each other.

If adult children are starting the conversation, begin with high-level questions regarding goals and expectations and the ways you can help (not what is in it for you). You are there to learn and understand. Some starters could be:

- “Mom, you have worked so hard to maintain the family ranch, what vision do you have for its future?”

- “Dad, if there comes a time when it is difficult for you to manage your investments and health care, what kind of assistance would you want us, as your children, to provide?”

This August 2017 article in MarketWatch, an online news service published by Dow Jones & Co., provides more instruction about how to continue these conversations.

We have had clients come to Braun & Gresham for estate planning after they have handled the distribution of a parent’s estate. Those clients often tell us that the planning done by their parents, combined with their parents’ thoughtful communication of their wishes, was a priceless gift. It eased their minds, minimized sibling conflict, and helped expedite the probate process.

This season, a simple and priceless gift that you can give to your family is taking the time to talk about a parent’s estate plan (or need for one) and their expectations about retirement and long-term care.

If you have any questions or want to learn more about the estate planning process before or after the holiday season, please call Margaret Menicucci at (512) 894-5426.

Plateau Land Group Featured Listing

Hill Country Views in Leander ETJ

72 Acres, $1,960,000

Leander, Travis County, TX

Rare undeveloped acreage with gorgeous Hill Country views, incredible elevation changes, a wet-weather creek, and two residences, just off the beaten path in Leander. This is an excellent opportunity to own a Hill Country gem with gorgeous trees, wildlife, and pristine land near major amenities.

View this listing here

View all of Plateau Land Group’s listings.

Click here to receive Plateau Land Group’s newest listings by email.

News for Texas Landowners

Texans can Take Steps to Prevent Spread of Oak Wilt

Article by Leighton Chachere with Texas A&M AgriLife

Oak wilt is one of the most destructive tree diseases in the U.S. and has been killing oak trees in Central Texas in epidemic proportions.

The Texas A&M Forest Service urges all Texans, particularly hunters, to take preventive measures and be cautious when collecting and purchasing firewood to reduce the spread of oak wilt.

“We all have a responsibility when it comes to limiting the spread of oak wilt,” said Jonathan Motsinger, Texas A&M Forest Service Central Operations department head. “One simple thing is ensuring that we are not moving firewood and potentially introducing the disease to new areas. Hunters on a ranch need to leave any wood they find there. Don’t take it back home and be the one who starts a new disease center…”

Monarchs, Bees Use Cultivated Milkweeds as much as Wild Ones

Article by Dana Kobilinsky with The Wildlife Society

Monarch butterflies and bee species use ornamental milkweed plants — the kind sold at garden centers — just as much as they use native plants, researchers found.

“There’s a ‘native-plant’ movement going on right now,” said Adam Baker, a researcher at the University of Kentucky College of Agriculture, Food and Environment and lead author of the study published in PeerJ. “We wanted to look a bit deeper into that, especially the use of cultivated native host plants in conservation gardens.”

Baker knew that cultivars — natural variants of native plants crossbred or hybridized with ornamentals for their appearance and disease resistance — can provide nectar and pollen at times where wild plants lapses.

He and his colleagues wondered how well monarch butterflies (Danaus plexippus) and bees benefited from them…

Accepting & Loving a River

Article by Daniel Oppenheimer for Rock & Vine Magazine

The Nueces River is vast, even by Texas standards. It starts high up on the Edwards Plateau.

Sourced by emerald, spring-fed creeks in Edwards and Real Counties, the Nueces River cuts through the rocky Hill Country before pivoting amidst the South Texas Brush Country, onward toward the coastal prairie; it pauses at Lake Corpus Christi, before it ultimately empties into the Gulf of Mexico at Nueces Bay.

Few, if any, know this river better than Sky Lewey. Born in Uvalde, Lewey was raised outside of town on the banks of the Nueces River. “I was swimming before I was walking,” she said.

The river has long supported Hill Country agriculture — cattle, cotton, wool and mohair production — while also providing fishing, hunting, and other recreational opportunities…

Recent Data Shows that Hunter Education Improves Hunter and Shooting Sports Safety

Press Release by Texas Parks & Wildlife Department

According to the 2019 Texas Hunting Incident Analysis, Texas has seen a substantial decrease in hunting-related accidents and fatalities since Hunter Education became mandatory in 1988. That year, over 18,000 Texans received their Hunter Education certification, but 12 fatalities and 70 accidents were still reported throughout the state. As more Texans have taken to the field and obtained their Hunter Education certification, these numbers have improved, with over 56,000 certifications in 2019 and only 1 fatality, and 21 accidents, reported statewide.

“The number one hunting incident during the general season is careless handling of a firearm in and around vehicles,” said Steve Hall, the Hunter Education Coordinator for the Texas Parks and Wildlife Department (TPWD). “Keep a firearm pointed in a safe direction at all times. This is the cardinal rule of hunting and shooting safety…”

Whooping Cranes are Heading to the Texas Coast

Press Release by Texas Parks & Wildlife Department

With the first sightings of iconic, endangered whooping cranes along the Texas coast, the Texas Parks and Wildlife Department (TPWD) is reminding Texans to be on the lookout for these impressive birds as they move through the state.

Whooping cranes are the tallest, rarest birds in North America. Currently, there is a population of around 506 individuals. Thanks to coordinated conservation efforts, whooping cranes are slowly returning from the brink of extinction.

Whooping cranes make a 2,500-mile journey from their breeding grounds of northern Alberta’s Wood Buffalo National Park to the coastal marshes of Texas each year. The migration south to Texas can take up to 50 days.

During their migration, whooping cranes seek out wetlands and agricultural fields where they can roost and feed. The birds often pass large urban centers like Dallas-Fort Worth, Waco and Austin…

Sorry, the comment form is closed at this time.