Seasons – November 2020

From the Plateau Land & Wildlife Management Team

Fall is officially here, and with the changing of the seasons comes another important season – property tax season! Many of you have already received or will be receiving, your property tax bills. It is very important that you review your property tax bill and be sure that it accurately reflects the market value of your property and that your agricultural valuation is in place. In this issue of Seasons you will find articles on how to read your property tax bill, the difference between the term exemption vs. valuation, opportunities to learn more about your property tax options – specifically wildlife management – and more!

Don’t forget that your taxes are due by January 31, 2021! If you are thinking about converting to wildlife management in 2021, this fall is the perfect time to start on your Wildlife Management Plan. Plateau is now offering $200 off your Wildlife Management Plan if you make the switch by November 30, 2020 (see more below). If you start early, you will be ready to file your application in early 2021.

Of course, if you have questions or would like to discuss your property tax options with an experienced member of the Plateau team, please give us a call at (512) 894-3479! We will be here when you need us.

Until next season and Seasons,

The Plateau Team

Table of Contents

Ag Exemption vs Valuation? Does it Matter?

Service Spotlight: FREE Wildlife Exemption Webinar Series

How to Read Your Property Tax Bill

Fall Wildlife Management Plan Sale

Plateau Land Group Featured Listing

News for Texas Landowners

Ag Exemption vs Valuation? Does it Matter?

By Shane Kiefer, Director of Ecological Services, Certified Wildlife Biologist and Registered Property Tax Consultant

At the end of the day, it’s a property tax savings, but using the right terms can help avoid confusion.

With the Texas legislature coming into session in 2021, I would normally expect at least one or two newspaper articles next spring about how some landowners are getting tax “exemptions” for having a few cows or some wildlife on their property and thus not paying their fair share of property taxes. Bigger issues are likely to dominate this coming session, but taxes and revenue are always in play. I’ve written before about why open-space appraisals are fiscally and socially sound, but I think the language we use helps contribute to misunderstanding.

As Plateau has learned over more than two decades of helping landowners with ag and wildlife “exemptions”, misunderstandings are common and conventional wisdom can be misleading. Even something as simple as what to call this significant property tax benefit can be confusing.

So what is it called?

- ag exemption

- timber exemption

- wildlife exemption

- ag exemption for wildlife

- agricultural appraisal for wildlife

- 1-d-1 exemption

- 1-d-1 valuation

- agricultural land in wildlife management use

- agricultural tax appraisal based on wildlife management

- agricultural property tax valuation

- wildlife management use valuation

- (just) wildlife management

- open-space special appraisal

- 1-d-1 open-space wildlife management special property tax valuation (that one’s a mouthful)

There are more, but you see my point. These are different names for the same animal. People use any and all of these in everyday conversations and internet searches. And it is not just the public… many appraisal districts list Ag, Timber, and Wildlife codes under “Exemptions” on the tax rolls alongside the true exemptions like homestead, over 65, and others. Your recent tax bill may even have listed Ag under your exemptions. No wonder there’s confusion.

The way we use words in our everyday language often differs from their technical definitions. The flu virus doesn’t cause stomach “flu” and Texans know putting hot dogs and hamburgers on a grill isn’t “barbecuing”, but that doesn’t stop people from using the terms that way. Many common names for plants and wildlife are good examples of this as well, but that’s another article. Language is dynamic, and what starts as a slang term may come to be a dictionary definition of a word. However, legal terms have very specific definitions… even though they are not always clear (hence lawsuits).

Technically, the wildlife exemption (or Ag or Timber) is a special appraisal based on productivity value. The Texas Constitution Article 8, Section 1 requires that all property “be taxed in proportion to its (market) value”. As with most taxes, the Constitution then lays out all the exceptions to this rule. Some property is exempt in whole or in part. An exemption means the value, or a portion of it, is not taxable. Most government property, property used for charitable purposes, et al. are fully exempt from taxation. Residence homesteads are partially exempt, meaning only a portion of the market value is not taxable.

Article 8, Section 1-d-1 of the Texas Constitution permits “open-space land devoted to farm, ranch, or wildlife management purposes” (timber, too) to be taxed based on its “productive capacity”. This is a different (i.e. special) way of assigning value, rather than an exemption of any part of the value. Notice that I used many of the terms from the Constitution in my earlier list. The Tax Code and the Comptroller’s Manual for the Appraisal of Agricultural Land dictate how the productive capacity is determined. Those details are not necessary to understand that the appraisal district assigns a value other than market value to a property for open-space tax purposes.

Why does it matter?

In the end, if you are getting good advice and doing what is required to receive your ag or wildlife exemption/valuation/special appraisal, then it doesn’t matter. You still get the tax break. There’s no quiz on legal terms required.

We know from experience, however, that the term “exemption” can cause confusion in other ways. Exemptions are often (not always) received based on a property’s status (ownership or classification, for instance). You have to earn a special appraisal based on the use of the land. There is some overlap here, but to avoid more confusion, let’s keep it simple. Land doesn’t receive an ag or wildlife valuation simply because of its status as rural land suitable for agriculture. The best wildlife habitat in the state isn’t automatically eligible for a “wildlife exemption”. It has to be used for agricultural or wildlife purposes in accordance with the established rules to qualify for a special appraisal. What you do with the land is what matters.

Another common point of confusion is with the actual ag or timber exemption – for sales tax. The ag and timber exemption for sales taxes is a true “exemption”. Certain products are not subject to sales and use tax. It’s important to point out that sales taxes and property taxes have nothing to do with each other and qualifying your property for an ag “exemption” for property taxes does not automatically qualify you for an ag exemption for sales taxes (or vice versa). The sales tax exemption (with some exceptions, of course) is based on your use of the purchased goods to produce agricultural or timber products for sale. Your land can qualify for an agricultural or wildlife valuation without any income requirements, but purchases are not exempt from sales taxes unless you are selling agricultural products.

We strive to provide the best available advice to landowners, so we prefer to use the technically correct language whenever possible. Our expertise won’t do you much good if we are speaking a different language, though, so having a shared vocabulary is important if we want to reach every landowner that needs advice. To that end, you will see us use wildlife exemption and ag exemption in an effort to make this information accessible to as many landowners as possible.

Whatever you call it – exemption, valuation, or just property tax savings – we are here to help. Contact us at (512) 894-3479 or [email protected] if you have questions, or would like to discuss your property tax options.

Back to TopBack to Top

Service Spotlight: FREE Wildlife Exemption Webinar Series

LAST CHANCE TO REGISTER FOR A FREE WEBINAR!

Whether you’re already a Plateau customer or someone that wants to learn more about Wildlife Management, everyone is invited to join us for our FREE 2020 Wildlife Management fall webinar series. Connect with experts and other Texas landowners in Wildlife Management and learn all about:

- Wildlife Management Exemption

- Wildlife Management 101

- Qualifying Wildlife Activities

- Property Taxes

- Wildlife Management Plans

- Annual Reports

- County Requirements

- Issues Related to Your Texas Region

- Open Questions & Answers

Webinars will be hosted every Tuesday and Thursday through November 12th. Visit plateauwildlife.com/webinars to register for the date and topic you choose. Register for as many as you’d like. If you miss one, no problem, just sign up for the next webinar!

Questions? Give us a call at (512) 894-3479 or email [email protected]

How to Read Your Property Tax Bill

By Cassie Gresham, Braun & Gresham Principal, Attorney & Counselor

Most landowners can expect to receive their property tax bills in October every year. It is too late to protest your values, but before you pay the bill, I would advise you to check and make sure that it accurately reflects the taxes that you owe. Here is a suggested checklist:

-

- Does it reflect the correct market value of the property? If you protested your market value, you will want to check to make sure that it reflects the final amount that was agreed to with the appraisal district. If you have an improvement on your land, then you will see three types of market values: (1) Improvement(s) (2) Land around your improvement(s), and (3) Land. If you have an open space valuation on the property, then you won’t pay based on the market value of the land. Instead, you will pay on the “assessed value”.

- Does it show your open space valuation? Check to make sure that your open space valuation (agricultural, wildlife, Ecolab, or timber) is reflected on your tax bill. This typically is shown under the “productivity” or “ag use” category. This will be much lower amount than the market value of the land.

- Does your tax bill reflect your exemptions? If you qualify for a homestead, over 65, or disabled veteran exemption, then they should be reflected on your tax bill. The taxing entities will cap the amount that they assess you if you qualify for a reduction due to your homestead or being over 65. You can apply for your homestead any time during the year and it can be retroactive for up to two years prior to the application.

- Did you receive multiple tax bills? While you only apply for exemptions or open space valuations in the county in which your property is located, you might receive multiple tax bills from different counties. This typically occurs in the case where the school district is located in a different county.

- What is your total assessed (taxable) value? This is the total amount that is used to calculate what you will pay in taxes. For example, your total market value might be $500K for your improvements and your land, but due to your exemptions and open space valuation, you may only be assessed taxes on $250K.

- When are your taxes due? Your taxes are due no later than January 31st of every year. If you pay after this date, then your taxes are delinquent. Paying your taxes on time is really important, even if there is a problem with your values or your bill. If you have an outstanding protest with the appraisal district or a lawsuit and fail to pay your taxes on time, then your protest or suit is automatically dismissed.

Your tax bill is the final look at the amount of taxes that you will pay. It is important that you remember to review your Notice of Appraised Value that comes out each year in April. Each year you have the opportunity to protest the loss of any open space valuation, exemptions, or market value of your improvement(s) and land. Your protest is due May 15th of each year, but no later than 30 days after you receive your Notice of Appraised Value.

If you have questions or concerns about your property tax bill, Braun & Gresham can help. The attorneys at Braun & Gresham are not only experts and innovators in ways to utilize property tax incentives and how to reduce your property taxes, but we also serve as your advocates when you are unfairly taxed. We know the rules and how to use them. We also make sure the taxing authorities follow those rules. Please contact us at (512) 894-5426 or email [email protected].

Fall Wildlife Management Plan Sale

Property tax bills for 2020 should have already been received, or will be arriving soon, and now is a great time to review your property tax status for 2021. If you are a landowner in traditional Ag or timber, and are considering converting to Wildlife Management in 2021, we are now offering $200 off our plan pricing until November 30th, 2020, or until 30 plans are sold – whichever comes first!

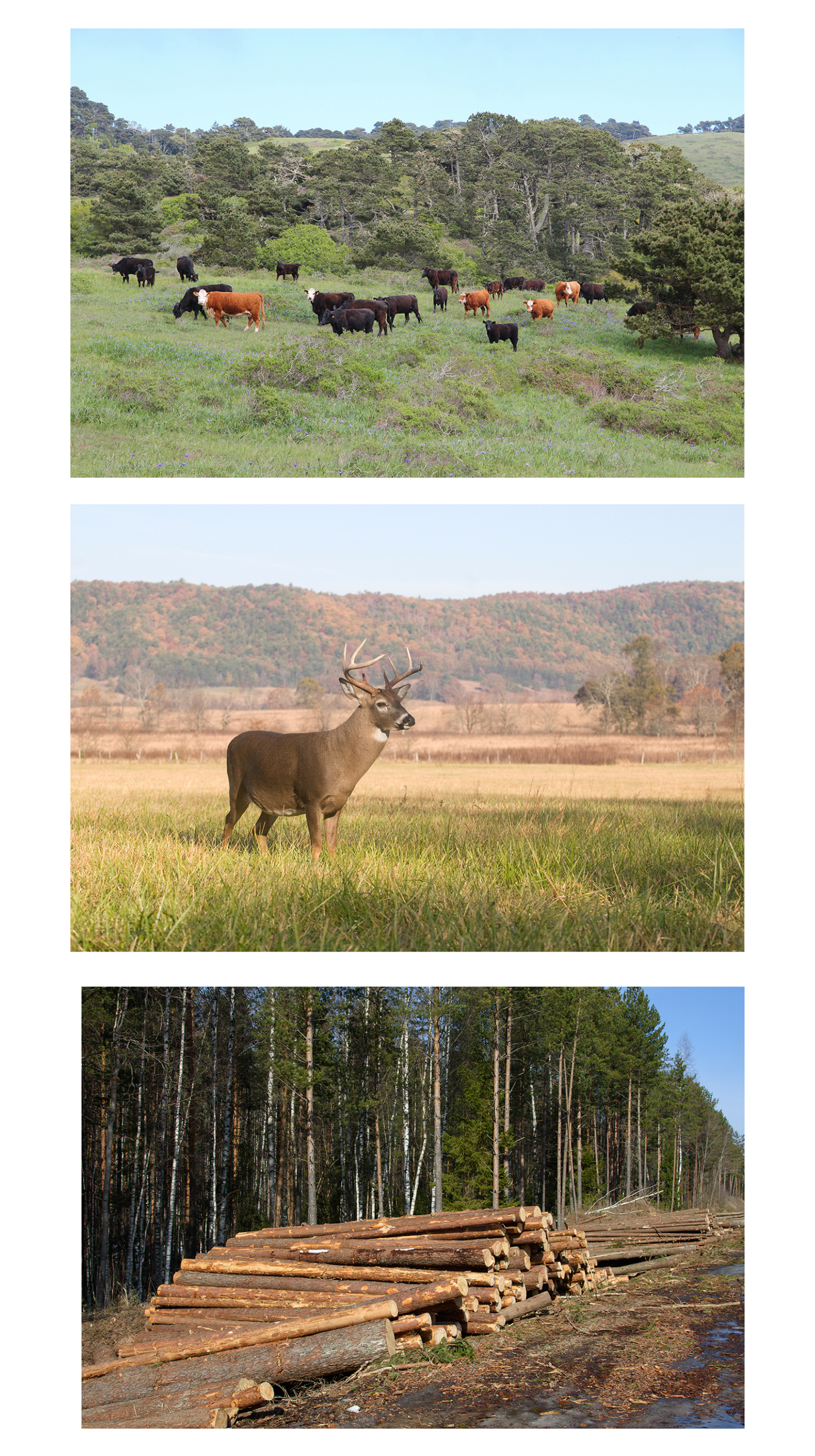

Benefits of Wildlife Management:

- Improved habitat & wildlife diversity

- No fencing or livestock requirements

- No timber harvesting requirements

- Same low property taxes as traditional Ag

- Multitude of management options

- Increased resale value

- Less time, stress & liability

Wildlife Management Plan Pricing:

- <30 acre property reduced to $1,550

- 31-100 acre property reduced to $1,795

- 101-200 acre property reduced to $2,095

- >201 acre property priced per bid

If you’re ready to make the switch to Wildlife Management or have questions about what’s included in our Wildlife Management Plan, call (512) 894-3479 or email [email protected] to get a quote or learn more.

Back to TopBack to Top

Plateau Land Group Featured Listing

Whitewater Springs Ranch

60 Acres, $669,000

Bertram, Burnet County, TX

A rare recreational ranch with tree-covered terrain rising 120 feet to majestic panoramic views, and sharing a common boundary on three sides with the Balcones Canyonlands National Wildlife Refuge, located within the Whitewater Springs development. A seasonal creek flows through the property, creating a lovely waterfall and a small pond. Abundant native trees and plants include live oak, cedar, cedar elm, prairie flameleaf sumac, American beautyberry, wildflowers, and an array of native grasses. A road from the gate leads to a campsite with old camp trailer, and trails connect throughout to view sites, deer blinds, property highlights, and the property boundaries.

View all of Plateau Land Group’s listings.

Click here to receive Plateau Land Group’s newest listings by email.

Back to TopBack to Top

News for Texas Landowners

Plateau and Braun & Gresham: TxN20 Honorees

Honoree Profile for

Texan by Nature (TxN), a Texas-led conservation non-profit founded by former First Lady Laura Bush, announced the honorees of the 2nd annual Texan by Nature 20 (TxN 20) – an official ranking of companies with Texas operations that have made a demonstrative commitment to conservation. Of those honorees, both Plateau and our sister company, Braun & Gresham, were recognized.

The TxN 20 recognizes the best and most innovative work in conservation coming from Texas-based business and operations. As part of the TxN 20, Texan by Nature honors companies across 12 industries in the Lone Star State whose ingenuity are forging new, beneficial paths in conservation. With 168 million acres of land paired with global leadership across multiple industries, Texas is fortunate to have industry leaders who see the value in partnering with conservation initiatives and developing innovative, sustainable methods and processes within their business.

Read Plateau and Braun & Gresham’s Honoree Profile

Public Ownership of Texas’ White Tailed Deer Re-Affirmed

Article by

The Texas Supreme Court recently denied review of an appeal in the case of Bailey & Peterson v. Texas Parks and Wildlife Department, affirming that the state’s white-tailed deer herd, including those held by breeders, are owned by the public.

“The Texas Supreme Court has ruled in favor of the Texas Parks and Wildlife Department in the litigation brought by two deer breeders against TPWD, Carter Smith, Clayton Wolf, and Mitch Lockwood challenging TPWD’s chronic wasting disease rules for deer breeders and seeking a declaration that breeder deer are private property. The Texas Supreme Court summarily rejected without oral argument the deer breeder’s request to appeal the opinion of the Third Court of Appeals that previously ruled in favor of TPWD,” TPWD said in a statement…

Innovative Agricultural Solutions Necessary to Advance Human Health, Sustain Natural Resources

Article by Carrie Baker with Texas A&M AgriLife

As the world’s population increases, scientists and agriculturalists face a growing challenge to produce more, higher quality food for consumers while using fewer natural resources and taking care to appropriately manage and conserve the resources that still exist.

Patrick Stover, Ph.D., vice chancellor for Texas A&M AgriLife, dean of the Texas A&M College of Agriculture and Life Sciences and director of Texas A&M AgriLife Research, discussed this challenge as he delivered the keynote address on the second day of the virtual EarthX Conference on conservation.

The international, live-streamed event took place Oct. 19-21 and was developed to “create understanding about how appropriately managed hunting, fishing and agricultural activities around the world are critical to further conservation, resulting in environmentally protective use of the biosphere,” the conference website reads…

Modest Quail Numbers Expected Statewide Ahead of Season Opener

Press Release by Texas Parks & Wildlife Department

Quail season opens in Texas on Oct. 31 and while the Texas Parks and Wildlife Department’s (TPWD) surveys have returned relatively low quail numbers in comparison to previous years, hunters hitting the field this season will see more favorable conditions in certain portions of the state.

“Texas quail live on the edge of feast or famine,” said Robert Perez, the Upland Game Bird Program Leader for TPWD. “Because Texas is such a large state, quail in one area of the state can be plentiful while quail in an area nearby may be difficult to locate. The population density of quail in February, along with the amount and timing of rainfall received throughout the year, and the amount of suitable habitat for the birds through time and space are the three key factors driving quail populations…”

Yes, There are Black Bears in Texas. Wildlife Experts Share Bear Hazing Safety Protocols

Article by Mary Claire Patton

Thanks to successful black bear conservation efforts over the last two decades, the iconic species is making a return to Texas.

The black bear is a protected species and is still considered rare for the state of Texas, according to Texas Parks and Wildlife officials.

Black bears have a protected status in Texas as they are still a threatened species and it’s against the law to hunt, harass or kill them.

A news release from TPWD officials on Oct. 20 notes that bear sightings are continuing to crop up in the west and southwestern regions of Texas…

As Concrete Sprawls, Fort Worth Plans to Spend Millions to Save Land from Development

Article by Haley Samsel

The land development boom in North Texas has shown no signs of slowing down, even with the significant economic challenges posed by COVID-19. That’s why Fort Worth officials are moving forward with plans to identify and potentially acquire natural areas for preservation before developers buy up the land for housing and retail projects.

“We want to really protect these key areas for our future generations, since once it’s gone, you can’t get it back,” said Jennifer Dyke, a city stormwater program manager who has led Fort Worth’s conservation efforts. “We really feel that open space conservation can help the city be more liveable for our community.”

The Open Space Conservation Program, a partnership between the city and the nonprofit organization Trust for Public Land, was originally launched late last year amid growing concerns over Fort Worth’s loss of an estimated 2,800 acres of natural prairie per year to development, among other issues…

Sorry, the comment form is closed at this time.